Research

Value Accrual Case Study: Yuga Labs | Guest post by Vader Research

This research piece has been written by Mete Gultekin from Vader Research.

Introduction – a16z vs Bored Ape owners

Value accrual is an essential yet often overlooked subject in Web3. We shall delve into how the value generated within the Yuga Ecosystem is apportioned among the diverse stakeholders within the Yuga Ecosystem (Yuga Labs, $APE, BAYC, MAYC, etc.).

We will be covering:

- Capital Structure & Enterprise Value

- Intrinsic Value

- Yuga’s Business Model

- Dilution

- BAYC Sale | May 2021

- MAYC Sale | Aug 2021

- $APE Launch | Mar 2022

- Otherdeeds Sale | May 2022

- Sewer Pass Launch | Jan 2023

- Yuga Ecosystem Earnings

- Multiple Stakeholder Problem

- Conclusion

1. Capital structure & enterprise value

In a web2 enterprise, the capital structure generally comprises equity and different tiers of debt. The senior debt lenders usually possess a higher collateral security but receive a lower interest rate, whereas the junior debt lenders hold less collateral security yet levy a higher interest rate.

Enterprise value is like the price tag on a company. It tells us how much the company is worth altogether, including how much money it owes to others (like banks) and how much money it belongs to the owners (like shareholders).

Enterprise Value = Equity Value + Debt Value

Lenders and minority equity shareholders have legal entitlements to the earnings and assets of the enterprise. In contrast, NFT and token owners do not enjoy such protections. Nevertheless, by including tokens and NFTs issued by Web3 companies as part of the overall capital structure, we can enhance the design and structure of value accrual.

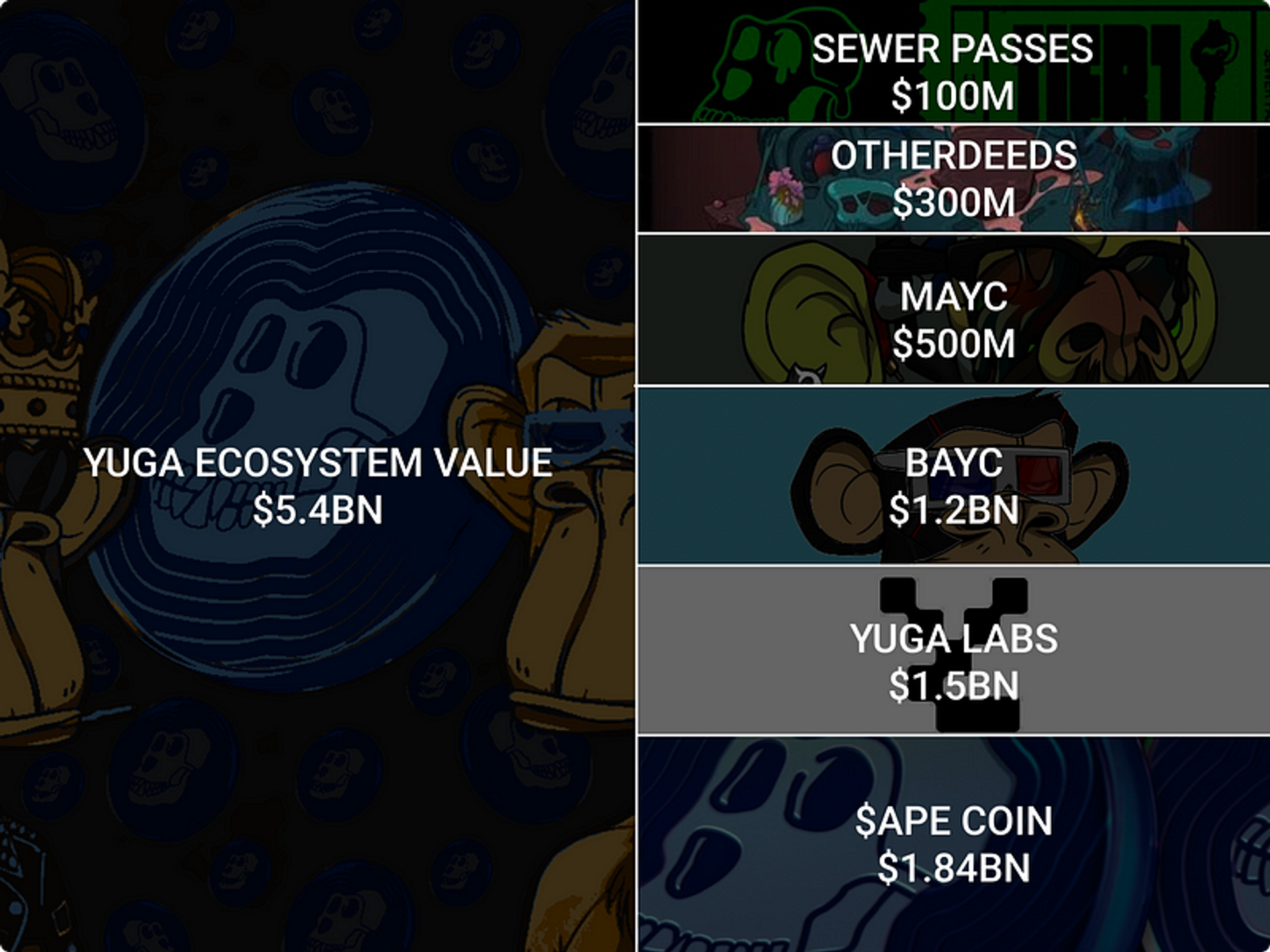

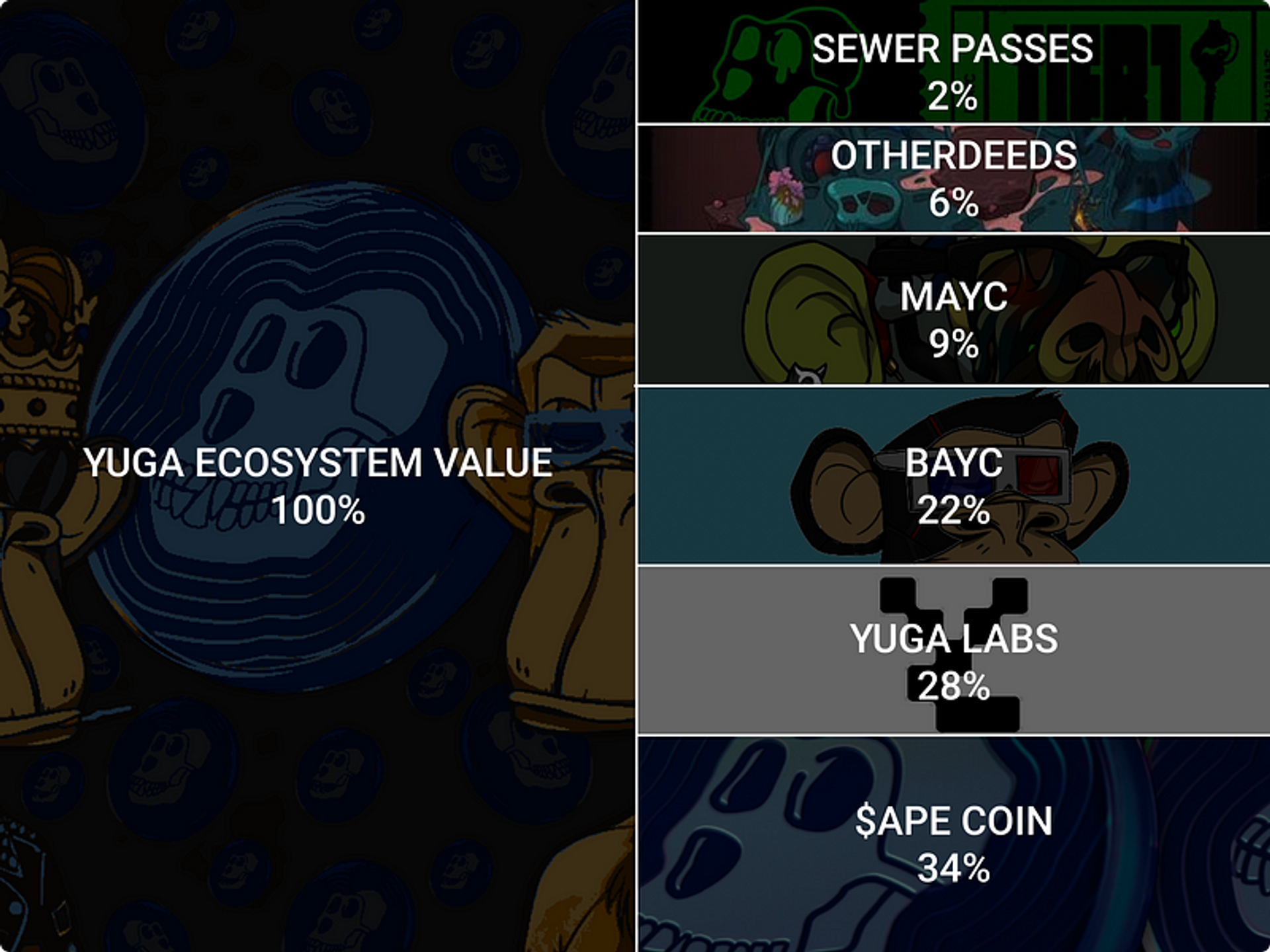

Using the same logic, Yuga Ecosystem Value is equal to how much the whole Yuga world is worth. It is the sum of how much money belongs to Yuga Labs Equity Entity and the value of all existing NFT collections (BAYC, MAYC, etc.) and tokens ($APE).

Yuga Ecosystem Value = Yuga Labs Equity Value + Value of Yuga NFTs & Tokens

2. Intrinsic value

Intrinsic value is how much something will be worth in the future, and we estimate it based on how much money it will make in the future. But because future money is not as valuable as current money, we make the future money a bit smaller, which is called discounting.

So, the fundamental value of a company, token or NFT equals its discounted future earnings. Using the same logic, Yuga Ecosystem Value equals its discounted future earnings.

Yuga Ecosystem Value = Discounted Future Earnings

3. Yuga's business model?

How does the Yuga Ecosystem generate revenue? Let’s examine the fundamental Yuga Ecosystem revenue streams.

Yuga has two primary revenue channels:

- NFT & Token Sales → creating and selling new tokens and NFT collections

- NFT Royalties → charging a fee for every secondary NFT transaction

4. Dark side of issuing new NFTs: dilution

The creation and sale of new NFT collections, such as BAYC, MAYC, and Otherdeeds, represent a significant source of revenue for the Yuga Ecosystem. Yuga Labs earned $100m from MAYC and $330m from Otherdeeds primary sales, while holding $2bn+ worth of Ape Coin and $40m worth of Otherdeeds on its balance sheet.

However, releasing new NFT collections has a downside: it dilutes the ownership of existing Yuga Ecosystem stakeholders (Yuga Labs, APE, BAYC). For existing stakeholders in the Yuga Ecosystem to benefit from dilution, the value created from issuing and selling a new NFT collection should outweigh the dilution costs.

The idea is akin to the concept of mergers and acquisitions (M&As), where the purchasing firm acquires the target company through an exchange of shares. As a result, the shareholders of the purchasing company experience dilution. The success of the acquisition hinges on whether the value created by the target company outweighs the cost of the dilution. If the value generated is greater, the acquisition is deemed successful; otherwise, it is considered a failure.

5. BAYC sale | May 2021

Yuga Labs created a new group of stakeholders, known as BAYC Holders, when they issued and sold 10K BAYC at $200* per item, earning $2M from the primary sale.

It’s important to note that NFTs sold by PFP projects and web3 game studios aren’t just virtual goods, people buy them with the expectation that their value will increase over time.

This is why BAYC owners are considered a separate stakeholder class in the Yuga Ecosystem, as the issuer company has a responsibility to these NFT owners.

Over the few months post-sale, the price of BAYC has risen significantly, reaching $66k by the end of August.

This means that the market value of BAYC could be as high as $660m, and if we assume a 1:1 conversion between the BAYC market cap and Yuga Labs’ equity entity valuation, then Yuga Labs’ would also be valued at around $660m.

In summary:

- 10k BAYC were sold by Yuga Labs in exchange for $2M

- BAYC Price rose from $200 to $66K in 4 months

- Yuga Labs had generated $2.5M in BAYC royalties by month 4

6. MAYC sale | August 2021

Let’s examine the issuance and sale of MAYC. Prior to the release of MAYC, BAYC had a market capitalization of approximately $660 million, and the ecosystem consisted solely of BAYC owners and Yuga Labs which was owned by the four founders.

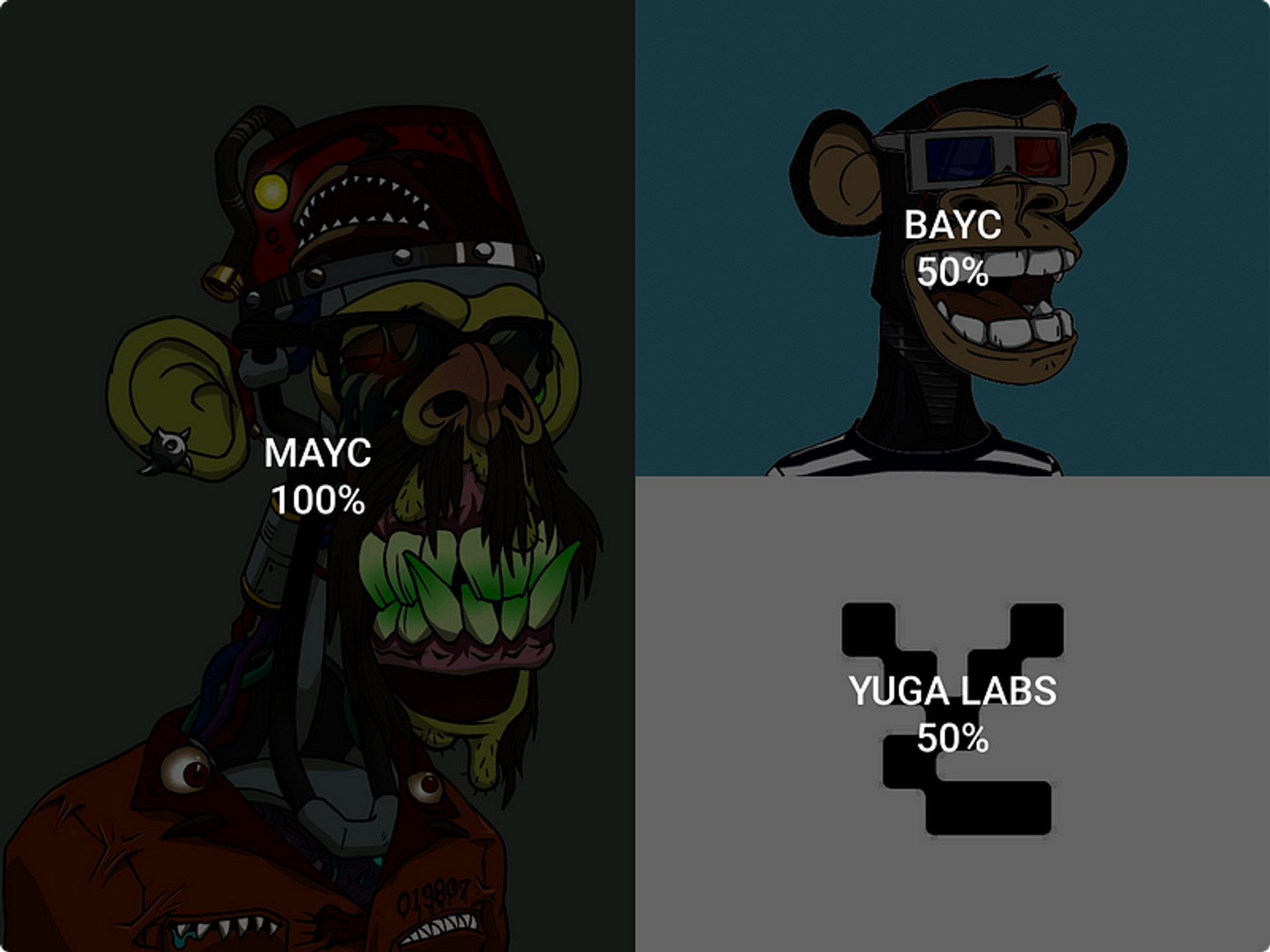

A total of 20,000 MAYC NFTs were created, with 10,000 sold to the public and 10,000 given to BAYC Holders. This means that Yuga Labs and BAYC each received 50% of the earnings from the issuance of MAYC.

Unlike other PFP NFT collections that offer no other financial returns than the change in price, BAYC Holders could claim future Yuga NFTs for free. This gave a clear message to BAYC Holders that they have a crucial seat in the Yuga Ecosystem.

Yuga Labs successfully sold the 10,000 MAYC NFTs for $10,000 each, earning $10 million. The 10,000 MAYC NFTs given to BAYC Holders were theoretically worth $10 million at the end of the MAYC sale.

At the time of MAYC issuance, some concerns were raised about its potential impact. Firstly, there was uncertainty regarding the ability of Yuga Labs to sell all 10k MAYC NFTs. Secondly, the sale of a new collection (MAYC) was feared to dilute value away from BAYC, leading to a decrease in BAYC NFT prices due to increased competition.

However, despite these concerns, the sale of MAYC proved to be a massive success for Yuga Labs, generating $10 million in revenue and paving the way for future NFT offerings.

In summary:

- 10k MAYC were sold by Yuga Labs in exchange for $100M

- MAYC Price rose from $10K to $58K in 7 months

- Yuga Labs had generated $25M in MAYC royalties by month 7

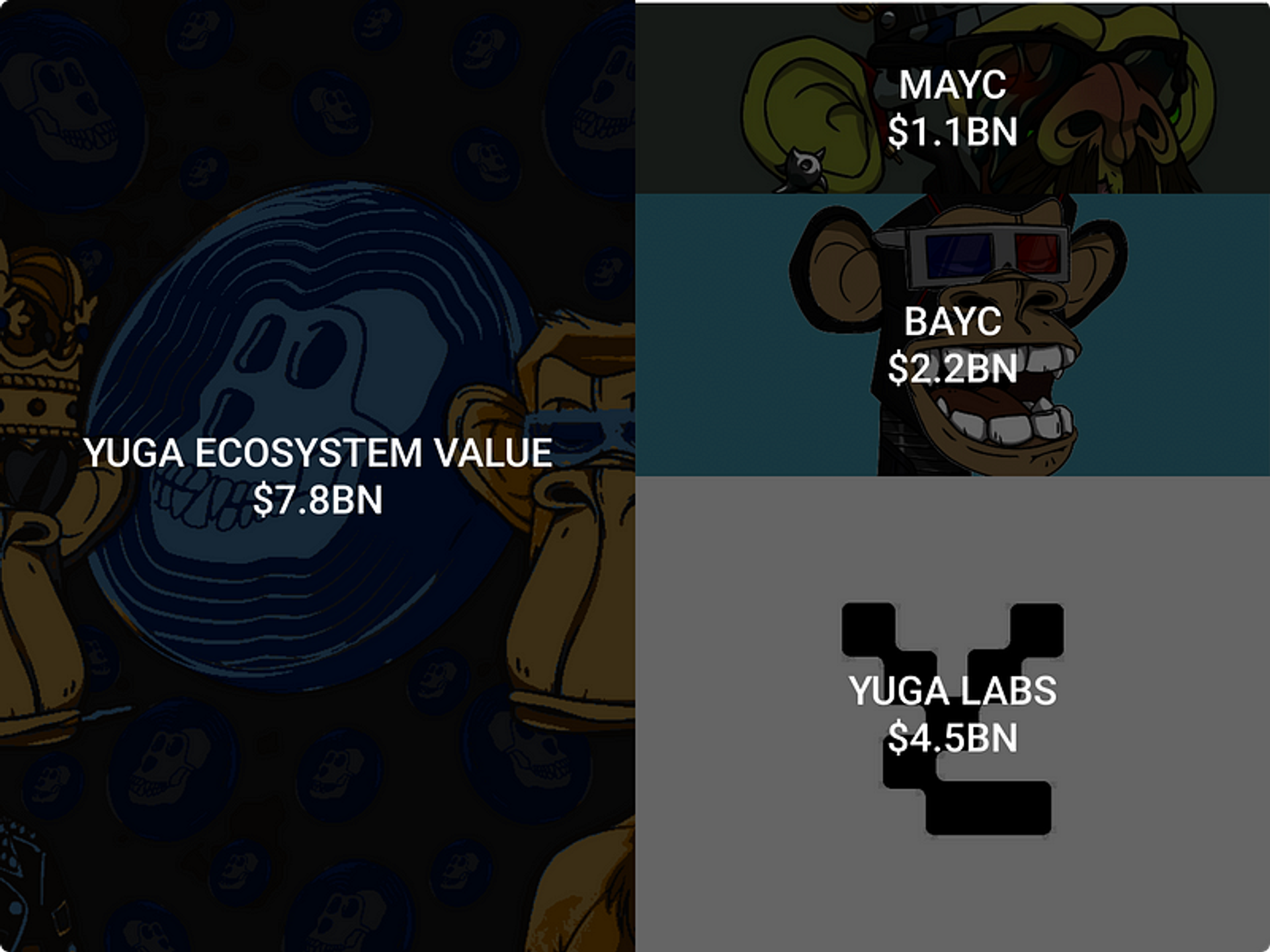

Several weeks prior to the launch of ApeCoin, Yuga’s inaugural token, BAYC was being traded at a staggering $2.2 billion, while MAYC was being traded at $1.1 billion. Yuga’s ability to generate immense new value by introducing new NFT collections had enticed well-funded late-stage crypto venture capitalists.

Yuga had secured a whopping $450 million in seed funding at a valuation of $4.5 billion, spearheaded by a16a, which would be made public in late March, just a few weeks after the launch of ApeCoin.

If we were to disregard our 1:1 NFT Market Cap to Equity rule and adopt the seed round valuation, the value accrual structure would appear as follows.

7. $APE launch | March 2022

The launch of $APE in March 2022 was a significant event for the Yuga ecosystem, and it was highly anticipated by the NFT community. Yuga Labs, had been gaining traction in the blockchain space with several successful launches.

As a result, many people were eagerly waiting for the launch of Apecoin, hoping that it would live up to the high standards set by Yuga Labs. In this section, we will discuss in detail the ApeCoin issuance and its impact on the Yuga ecosystem.

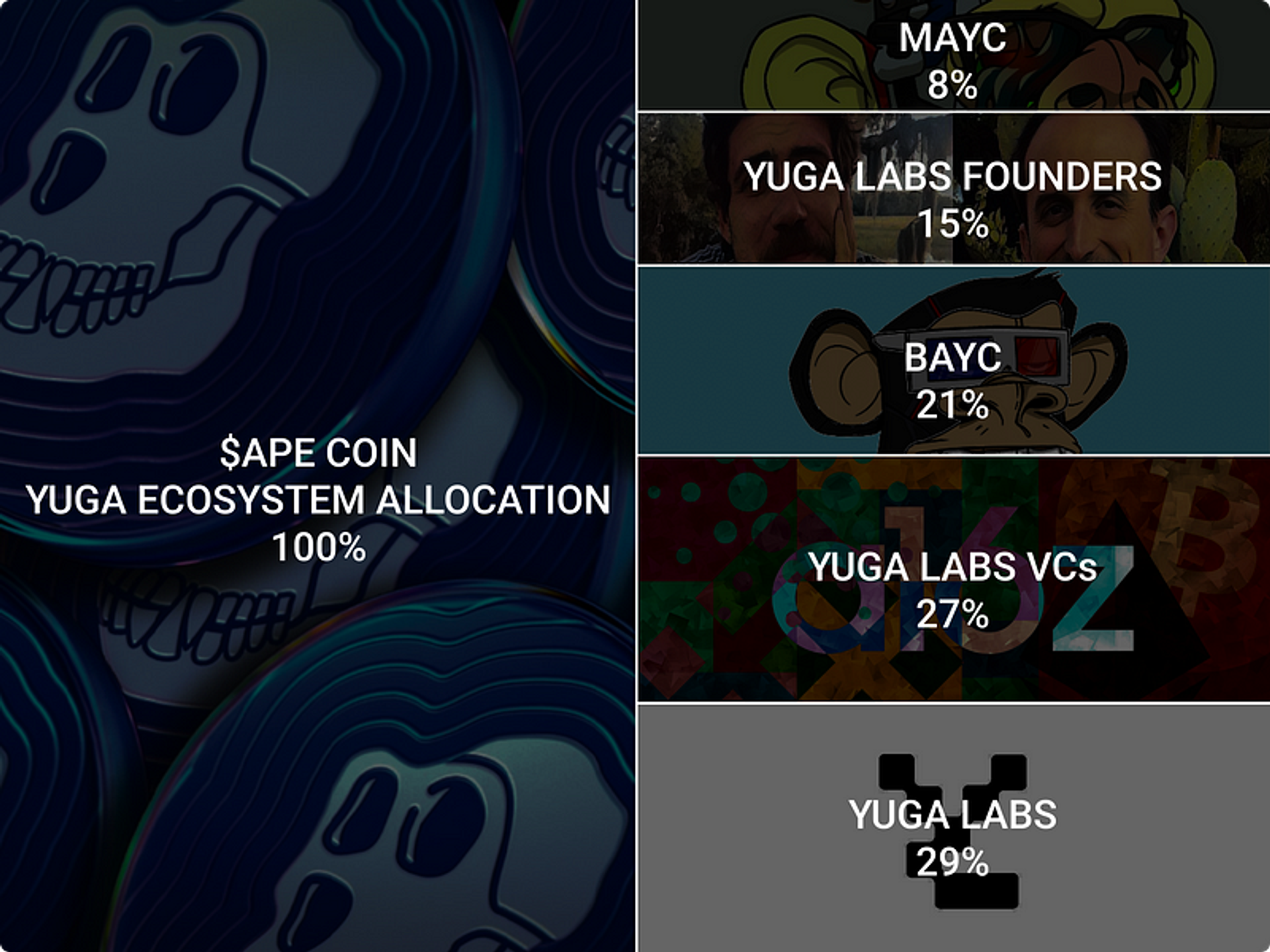

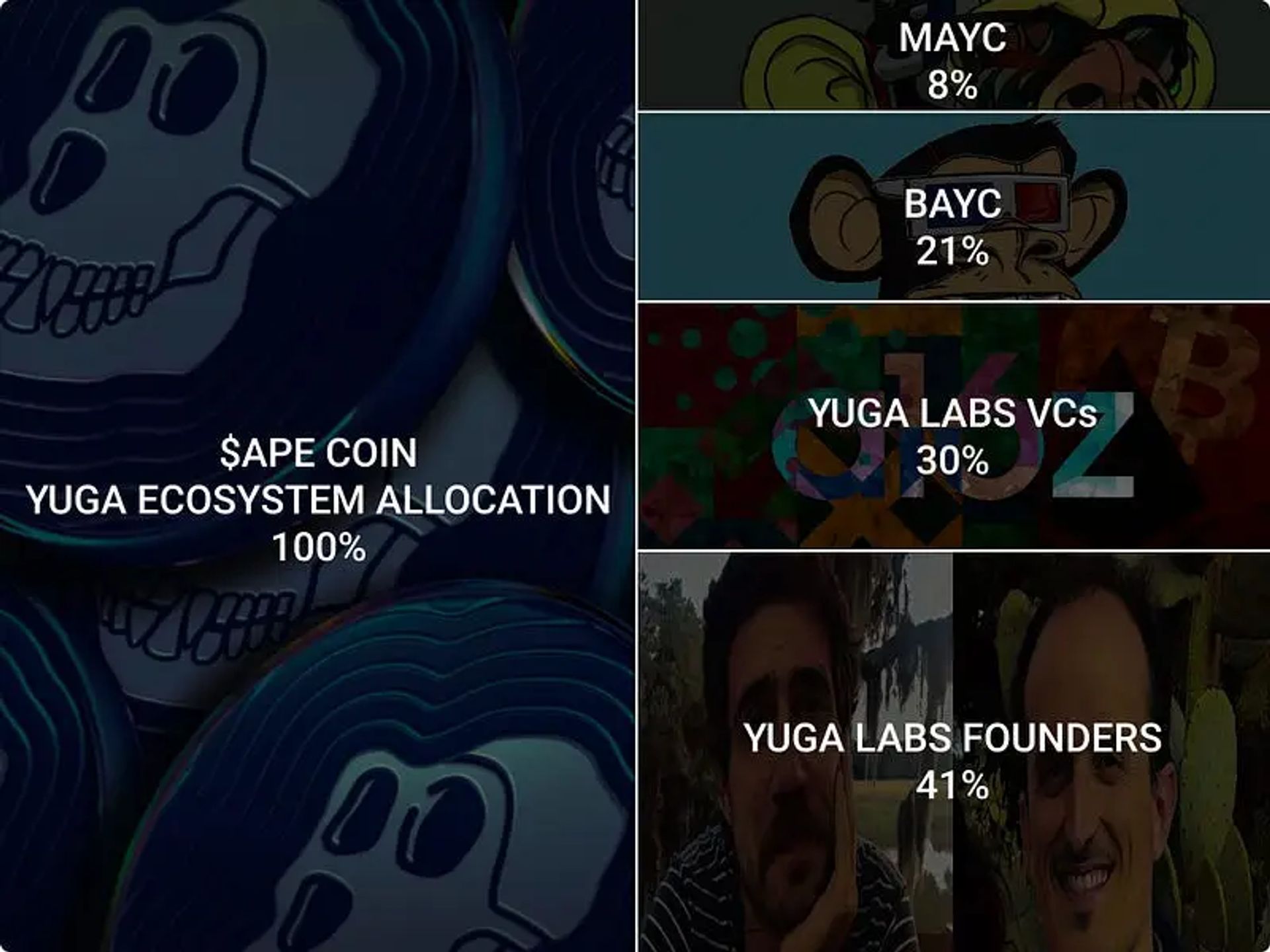

The initial token allocation was designed to allocate 47% of tokens to the ecosystem, 15% to Yuga Labs, 1% to charity, 8% to founders, 14% to VCs, and 15% to BAYC & MAYC holders.

Our definition of Yuga Ecosystem Stakeholders (Yuga Labs, BAYC, MAYC, VCs) was allocated a cumulative 52% of tokens. Let’s look at the distribution within that 52%:

While the aforementioned numbers provide some insight, they do not provide the complete picture. It is important to note that the VCs and Founders of Yuga Labs also have a vested interest in Yuga Labs, which means they are indirectly receiving more tokens than the figures stated earlier. Therefore, it is necessary to analyze the numbers further to get a more accurate distribution of tokens.

Let’s assume that no employees or advisors have any ownership in Yuga Labs, and we’re also excluding the potential equity dilution from the Larva Labs (CryptoPunks IP) acquisition. Based on the $450M seed round, it appears that Yuga Labs Founders own 89% of the company, while Yuga Labs VCs own the remaining 11%. When we tally up the numbers, this translates to a token allocation of 41% for Yuga Labs Founders and 30% for Yuga Labs VCs.

The allocation of $APE Coin differed significantly from that of MAYC. While the distribution of 20k MAYC was divided equally between Yuga Labs and BAYC holders, the allocation of $APE Coin favored Yuga Labs shareholders over BAYC and MAYC holders.

Our calculations indicate that Yuga Labs and its shareholders received 71% of the allocation, while BAYC/MAYC holders received only 29%. This equates to a 2.4:1 ratio, which is higher than the 1:1 ratio for MAYC allocation. As a result, a16z and Yuga Founders received a greater $APE Coin allocation at the expense of BAYC and MAYC holders.

It’s worth noting that the tokens assigned to BAYC and MAYC holders were immediately accessible, while those assigned to Yuga Labs, VCs, and Founders have a 4-year vesting period.

Nevertheless, it’s important to consider that if the token allocation had been distributed evenly between Yuga Labs shareholders and BAYC/MAYC owners, BAYC/MAYC owners would have had the option to claim their allotted tokens gradually over a four-year vesting period.

8. Otherdeeds sale | May 2022

In the days leading up to the Otherdeeds sale, Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), and $APE coin were all trading at their all-time highs.

BAYC boasted a staggering ~$4 billion market cap, MAYC had reached ~$2 billion, and $APE coin had a market cap of $6.5 billion. Yuga Labs had managed to turn 10,000 utility-less monkey JPEGs into a multi-billion-dollar empire in less than two years!

It’s worth noting that the NFT collection market cap is calculated based on the floor price multiplied by the circulating supply, so the actual valuation may have been much lower if someone wanted to purchase all circulating Yuga Ecosystem assets in one transaction.

Out of the 100k Otherdeeds issued in total; 55k were sold publicly, 10k given to BAYC, 20k given to MAYC, 15k reserved by Yuga Labs.

In total; 70% of Otherdeeds were allocated to Yuga Labs. We are seeing another case where Yuga Labs got overallocated at the expense of NFT & $APE token Holders. Additionally; MAYC Holders got overallocated at the expense of BAYC Holders. And $APE holders didn’t get any Otherdeeds allocation.

Of the 100,000 Otherdeeds issued, 55,000 were sold publicly, 10,000 were given to BAYC, 20,000 were given to MAYC, and 15,000 were reserved by Yuga Labs. In total, 70% of the Otherdeeds were allocated to Yuga Labs.

We are witnessing another instance where Yuga Labs received a relatively excessive allocation at the expense of BAYC/MAYC NFT and $APE token holders. Additionally, MAYC holders were overallocated at the expense of BAYC holders, and $APE holders did not receive any Otherdeeds allocation.

In summary:

- Yuga Labs sold 55k Otherdeeds NFTs for $310M. $310M worth of purchasing power was utilized to acquire Otherdeeds NFTs but Yuga Labs pledged not to touch the $APE proceeds for 1 year. As a result, the current value of Yuga’s $APE proceeds from the Otherdeeds sale is roughly $80M.

- Otherdeeds Price fell from $31k to $2k in 7 months

- Yuga Labs had generated $56M in Otherdeeds royalties by month 7

Although we previously stated that APE holders did not receive any allocation of Otherdeeds, it is important to note that the primary sale occurred using $APE. However, using APE as the medium of exchange for buying Otherdeeds assets in the auction does not necessarily result in the accrual of value to $APE or make it a sustainable sink.

Value can only accrue to $APE permanently if the 16M $APE sent by Otherdeeds purchasers was deposited into $APE DAO’s treasury wallet. If that were the case, the excess APE held in the treasury would be subject to collective voting by the APE governance on how to utilize it, as it would remain on APE DAO’s balance sheet.

Let's walk through a hypothetical example as follows: Every month, 5 million APE tokens are emitted into circulation via pre-scheduled token unlocks and staking rewards. Additionally, we can see that 1,000 APE tokens are transferred from circulation back into the $APE treasury every month through the sale of Sewer Pass IAPs in Yuga’s mobile game (which we will discuss shortly).

The value of $APE theoretically increases as more tokens accumulate in the treasury. However, if the tokens are not accumulated in the treasury and are instead staked, this only delays the inevitable — Yuga Labs selling their own token allocation.

Regarding the Otherdeeds sale, it is important to note that the $APE payments made by purchasers went directly to Yuga Labs’ wallet, rather than the APE DAO’s treasury. This means that Yuga Labs has full control over those tokens and can sell them at any time, distributing the proceeds to its shareholders. However, Yuga Labs did make a promise not to sell the $APE tokens earned from the Otherdeeds sale for a period of one year.

Essentially, Yuga Labs is quasi-staking $APE for one year, but it is likely that they will sell some portion of it at the end of the year. This results in a one-year sink for the $APE tokens, but in reality, the tokens earned from the Otherdeeds sale are still under Yuga Labs’ control.

In this hypothetical example, we demonstrate that in a scenario where Yuga Labs regularly sells 5 million $APE every month, the proceeds earned from Otherside sale only serve to slow down the sell pressure on $APE temporarily.

9. Sewer pass launch | January 2023

Prior to the launch of Sewer Pass, the value of Yuga’s assets had declined alongside the broader cryptocurrency market. Specifically, the Yuga Ecosystem Value fell from $17 billion in May 2022 to $3.8 billion in January 2023.

The release of Sewer Pass NFTs was accompanied by a hypercasual game called Dookie Dash. We had previously conducted a thorough analysis of the gamified drop mechanism on Twitter.

https://vaderresearch.com/media/f2d797fd72a53df5507d0bd6f9245952

Let’s now examine the structure of the Sewer Pass issuance

A total of 26,500 Sewer Passes were issued, and they were distributed among BAYC and MAYC owners. We will not delve into the specifics of the allocation between the two groups and will assume an even distribution. The Sewer Passes supposedly serve as a gateway to a new Yuga NFT collection.

Yuga Labs opted to generously reward the entire collection to BAYC and MAYC holders, whereas they had excluded themselves from this issuance. However, APE Coin and Otherdeeds holders did not receive any rewards.

Dookie Dash in-game microtransactions can be purchased using $APE currency, and the proceeds from these transactions are deposited directly into the $APE DAO’s Treasury. Nonetheless, the total earnings from these microtransactions are trivial when compared to the value of Sewer Pass NFTs.

Here’s the current Yuga Ecosystem capital structure as of March 2023

10. Yuga ecosystem earnings

The table displays the revenue generated by Yuga Labs, BAYC, and MAYC from the issuance and sale of Yuga NFTs and tokens. While BAYC and MAYC holders appear to have earned a greater sum of $1.3 billion and $572 million, respectively, Yuga Labs’ earnings of $412 million exclude the tokens and NFTs held in their reserves. It is noteworthy that Yuga Labs holds $2 billion worth of $APE Coin in their reserves.

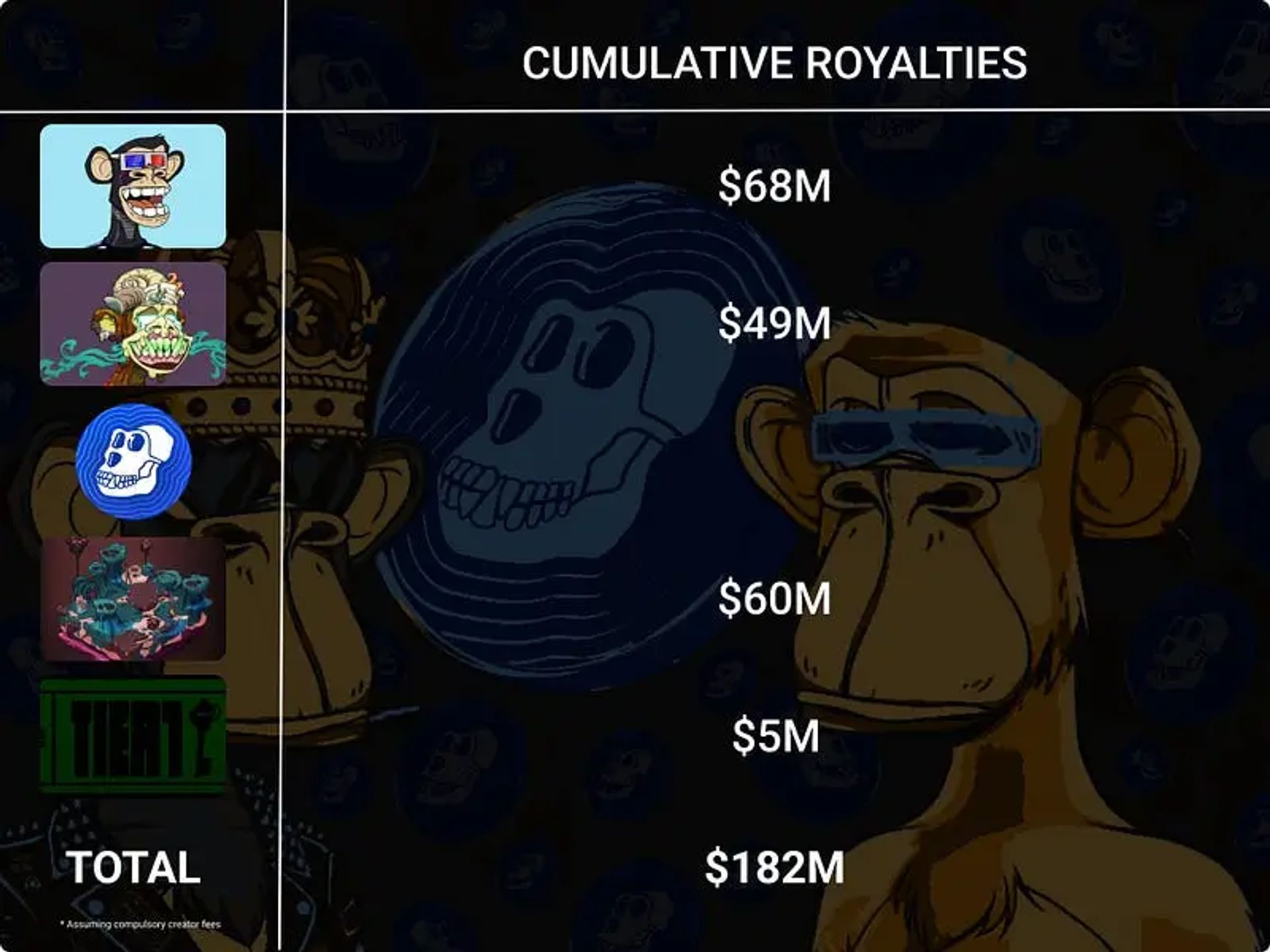

Royalties have emerged as a significant source of revenue for NFT projects, although their viability has been challenged by the ongoing NFT marketplace wars.

Yuga Labs, levies a 2.5% charge for BAYC and MAYC, while they charge 5% for Otherdeeds and Sewer Passes. Notably, all royalties earned are exclusively channeled to Yuga Labs, with no distribution to other stakeholders in the Yuga Ecosystem. As a result, Yuga Labs has amassed a cumulative revenue of $182 million from royalties.

Royalties have yielded substantially lower earnings in comparison to primary sales. As we have previously contended, primary sales are a superior mechanism for monetizing intellectual property. Nonetheless, royalties can serve as a supplementary revenue stream, offering an additional means of income.

https://vaderresearch.com/media/a2f5dafe1012f0e046422b28fa757370

11. Multiple stakeholder problem

One of the biggest challenges that arise when dealing with multiple stakeholders is MISALIGNMENT OF INTERESTS. Due to the absence of legal or predetermined smart contract decisions regarding who is entitled to what, each stakeholder may strive to maximize their short-term earnings. At some point, there will likely be an internal conflict between multiple stakeholders as each one lobbies to accrue value to their assets.

To prevent this, Yuga Labs must be responsible for managing multiple stakeholders in a relatively fair manner when structuring new issuances and creating new earning channels. A well-designed structure should aim to minimize misalignment of interests and maximize collaboration across all stakeholders.

Food for thought:

- Suppose Yuga were to launch a new collection tomorrow. How would the company distribute this collection among its stakeholders?

- If Sewer Pass holders don’t receive any airdrops, what value or utility does a Sewer Pass have? Why would anyone continue to hold onto their Sewer Pass? Why wouldn’t they sell it? The same question applies to Otherdeeds.

- What percentage of gaming/metaverse earnings will be shared among Yuga stakeholders? Will BAYC/MAYC holders not receive any stake from gaming earnings?

- If gaming earnings are only distributed between $APE and Otherdeeds holders, what will be the split? Will it be 50/50? 80/20? Will the split be based on recent market prices or primary sale prices?

Let’s consider this from the perspective of a retail investor. If one were to invest in the Yuga Ecosystem, which asset should he buy?

This question is crucial because each asset provides exposure to different channels of earnings within the Yuga Ecosystem. It would be highly disappointing for an investor if Yuga were to do very well in the future, but the asset they had purchased underperformed compared to other Yuga assets.

There is a compelling value proposition for buying BAYC and MAYC. By owning these assets, investors receive a certain percentage of every new Yuga NFT or token issuance. Even though Yuga may sometimes allocate fewer rewards to BAYC and MAYC holders, they still receive a certain percentage from the issuance.

If you believe that Yuga’s future NFT and token collections will be valuable, then BAYC or MAYC is the asset to purchase. However, you won’t get exposure to Yuga royalties. The minimum amount of capital required to make such a purchase is relatively high, as the floor prices for BAYC and MAYC trade at $110k+ and $20k+ respectively.

$APE coin, on the other hand, has yet to provide a clear value proposition. $APE currently offers vague and shallow “utilities,” none of which explain how Yuga Ecosystem earnings can accrue to $APE. While being used to purchase Otherdeeds provided temporary value to the token, it just delays the inevitable. Once $APE tokenholders realize that the value created from the Yuga Ecosystem doesn’t accrue to $APE, they will have no reason not to sell it.

Paying for in-game microtransactions with $APE is a clearer utility (assuming earnings go to $APE DAO’s treasury). We will likely see more $APE utility through Yuga’s gaming/metaverse initiatives. However, Yuga has yet to announce the utilities of existing assets. Delaying this announcement is actually a smart move on their part as it results in even more speculation and anticipation among asset holders.

That being said, there is a risk of upsetting asset owners by failing to deliver on promises. Even if Yuga delivers a great IP/game/metaverse, if BAYC holders or Yuga Labs gain relatively more from it than $APE or Otherdeed holders, then those holders will be upset.

12. Conclusion

Value accrual structuring is a challenging subject in the world of web3. Each set of NFTs or tokens that a project issue becomes a liability on the project’s web3 capital structure. To ensure that all stakeholders are aligned and working together effectively, it’s essential for projects to have a well-designed value accrual structure.

If you’re an investor, it’s important to conduct thorough due diligence to fully understand the earnings and value channels you’ll be exposed to. It can be incredibly disappointing to be right about the project and team you’re investing in, only to realize later that you’ve made a mistake in your choice of asset.

In short, a well-structured value accrual model is crucial for the success of web3 projects, and investors should take the time to fully understand the assets they’re investing in to avoid disappointment down the line.

Notes

Yuga Labs Ecosystem encompasses a range of assets, including Yuga Labs Equity Entity, BAYC, MAYC, Otherside, $APE Coin, Sewer Passes, and Future NFT Collections & Tokens Issued by Yuga Labs. For the purposes of simplicity, we have omitted BAKC and Larva Labs IPs (CryptoPunks, Meebits) that were acquired by Yuga Labs.

Our calculation of the NFT market cap is based on the end-of-month NFT floor price or monthly average sales price multiplied by the circulating NFT supply. It should be noted, however, that if an acquirer were to purchase all NFTs in a given collection simultaneously, the actual figure would likely be lower than the estimated market cap.

Regarding the $310M generated from the Otherdeeds sale, it is worth noting that the payment was made in $APE Coin and $APE was airdropped to BAYC and MAYC holders several weeks prior to the sale. As a result, some argue that the actual figure should be lower than $310M. However, BAYC and MAYC holders were given the option to exchange $APE for USD, and $APE was trading at a market cap of $10bn+. While it is true that if all BAYC and MAYC holders sold $APE simultaneously, the price of $APE would have fallen, it does not negate the fact that $310M worth of purchasing power was used in the primary Otherdeeds sale.

Applying the same logic as in above, we estimate that the $APE tokens held as reserves in Yuga Labs’ balance sheet are likely less than $2BN. If Yuga Labs were to sell such a large volume, it would significantly impact the markets. A more appropriate methodology may be to apply a 10–20% discount on the NFT market cap and a 30–40% discount on the tokens held in reserves.

None of this is financial or legal advice. If you want Vader Research to consult with your team on value accrual structuring or web3 game economy design, reach out to Vader Research.

The authors of this content, or members, affiliates, or stakeholders of Token Terminal may be participating or are invested in protocols or tokens mentioned herein. The foregoing statement acts as a disclosure of potential conflicts of interest and is not a recommendation to purchase or invest in any token or participate in any protocol. Token Terminal does not recommend any particular course of action in relation to any token or protocol. The content herein is meant purely for educational and informational purposes only, and should not be relied upon as financial, investment, legal, tax or any other professional or other advice. None of the content and information herein is presented to induce or to attempt to induce any reader or other person to buy, sell or hold any token or participate in any protocol or enter into, or offer to enter into, any agreement for or with a view to buying or selling any token or participating in any protocol. Statements made herein (including statements of opinion, if any) are wholly generic and not tailored to take into account the personal needs and unique circumstances of any reader or any other person. Readers are strongly urged to exercise caution and have regard to their own personal needs and circumstances before making any decision to buy or sell any token or participate in any protocol. Observations and views expressed herein may be changed by Token Terminal at any time without notice. Token Terminal accepts no liability whatsoever for any losses or liabilities arising from the use of or reliance on any of this content.

Stay in the loop

Join our mailing list to get the latest insights!

Continue reading

- TEMPLATE weekly fundamentals

TEMPLATE weekly fundamentals

The latest from Token Terminal: new listings, metrics, and datasets. Stay informed with data-driven insights from Token Terminal Pro, and discover the latest updates to our API and Data Room offerings.

- Customer stories: Token Terminal’s Data Partnership with Linea

Customer stories: Token Terminal’s Data Partnership with Linea

Through its partnership with Token Terminal, Linea turns transparency into a competitive advantage and continues to build trust with its growing community.

- Customer stories: Token Terminal’s Data Partnership with Linea

Customer stories: Token Terminal’s Data Partnership with Linea

Through its partnership with Token Terminal, Linea turns transparency into a competitive advantage and continues to build trust with its growing community.